Container home insurance is something most container homeowners need, but it has a reputation for being tough to understand and find. The difficulties start with confusing terminology and subtle distinctions in the insurance industry, then combine with the general public’s lack of familiarity with container construction.

In this article, we will explain why you might need homeowner’s insurance for container homes, help you become familiar with the container house insurance industry, as well as show you how to find and select the right container home policy for your situation. While our focus here is primarily on container homes in the United States, the majority of what we share is relevant regardless of where you live.

The home insurance industry is complex, with a lot of moving pieces. While we certainly can’t make you an expert on insurance with one article, we’ll do our best to distill the most important and relevant points you need to know to make smart financial decisions. Let’s get started!

The Importance of Insurance for Container Homes

It’s worth understanding if and when you actually need an insurance policy for your shipping container home, instead of just assuming that you do. Insurance is one of those things that is definitely not a one-size-fits-all situation.

Remember that insurance is simply an economic tool used to pool together risk from many individuals, then transfer that risk to a company. The insurance companies make money by collecting more in insurance premium payments than they pay out in claims. However, remaining profitable requires them to have a very detailed understanding of all their assumed risks.

As far as when you might need home insurance, there are two main scenarios to consider. Either it’s a requirement of your mortgage company, or it’s simply a prudent decision for your personal financial health.

Home Insurance for Bank Risk

If you finance the purchase of your container home, the lender is likely to require you to have insurance on the home. Understand that this isn’t universally true, as some types of loans don’t actually consider your container home as collateral against the loan.

But for those loans that are secured by a container home, the lending entity or bank will require you to have an insurance policy. This isn’t to protect you, though that may be a secondary benefit depending on your policy.

The purpose of a container home policy in this case is to protect the lender. In case anything happens to your container home before you’ve paid off your loan, the lender needs a way to recover the money given to you to purchase the home.

Home Insurance for Personal Financial Risk

Whether your finance the purchase of your container home or not, you need to understand the personal risks that come with home ownership. There is always the small (but expensive!) chance that your home is affected by a natural disaster, a criminal act, or other unforeseen events.

A good homeowner’s policy will help shield owners from the extraordinary financial costs that may result from some of these low-probability events. In later parts of this article, we’ll cover more examples of these risks and the types of insurance coverage that protect against them.

For now, think about whether you have the financial resources to self-insure. Self-insuring means you will pay for the costs of these potential home damages or liabilities out of your pocket. And remember that for most families, their home is the largest financial asset they have.

Self-insuring using your personal capital is not a risk that the majority of homeowners are willing to take. In general, self-insurance is best used for risks that are high-frequency but low severity.

On the contrary, low-frequency risks with high severity are best addressed with insurance. Thus, some type of container house insurance is needed for the majority of homeowners.

The Challenges of Container Home Insurance

Container homes are known for being difficult to insure, and that reputation isn’t completely false by any means. But understanding why that’s historically been the case and how it is changing is important as you think forward to purchasing insurance coverage for your own home.

Historical Background of Container House Insurance

Container homes are unique and not commonly found in most communities, meaning that insuring them is a more complex process than normal. A few insurance issues for container homes include:

- Comparables: The basis for home valuation is looking at comparable sales. Comparables analysis is essentially determining the resale value of your container house by studying the value of nearby, similar homes. Something is only worth what someone else will pay for it. But with container homes making up only a sliver of the overall home market, nearby comparables are often hard to find. As we often say, container homes are unique and not for everyone. As a result, the audience of potential buyers of a container home is likely smaller than a traditional home.

- Building Quality: Insurers want to be confident in the quality of the asset they are insuring. With many inexperienced container home contractors out there, plus the additional unknowns of DIY home builders, insurers may see a container home as a gamble with respect to building quality. Specific concerns include craftsmanship, structural integrity, and material quality. While you can argue that container homes are fundamentally less risky than traditional construction, people less familiar with container construction may be less confident in their strength and durability.

- Regulations: A complex web of building codes and zoning rules plus insurance requirements that differ by country and state means that a policy that works in one place might not work in another, even if the homes are otherwise the same.

Given some of these historical issues, it’s understandable that some home insurance companies in past years were not interested in insuring shipping container homes. They had plenty of business with traditional homes, which are comparatively straightforward and simple to insure.

The Evolving Container Home Insurance Market

Despite all the changes we’ve seen in recent years, fires still burn, thieves still exist, and pipes still break. Most of the external risks will never go away, ensuring we’ll always need the insurance industry. What has gradually changed over time are some of the issues facing container homes that we presented in the previous section.

Thanks to the continued popularity of shipping container construction, there are more comparables to be found than ever before. And professionals across the insurance industry are increasingly familiar with container homes thanks to all the media coverage.

The quality of container homes continues to increase as container builders gain more experience and container construction best practices are shared across the industry. And related to that is the fact that regulations pertaining to container construction are slowly catching up, with the International Residential Code actively working to further streamline the pathways for full code compliance.

These changes intersect with the increasing acceptance of other types of alternative construction, like log homes, dome homes, and straw bale homes. More and more companies are starting to embrace home insurance coverage for these and other types of unique houses. This acceptance of adjacent types of novel construction techniques only helps with finding companies willing to provide insurance for container houses too.

Home Insurance Companies and People

If you want to understand the home insurance industry, you need to understand the players involved. There are a variety of organizations, companies, and individuals who all have a hand in creating and managing insurance policies. In addition to you, the insured party, we can group the other insurance players into three broad groups.

Insurance Providers

An insurance provider, sometimes known as an insurance carrier, insurance company, or simply an insurer, is the entity that actually holds the assets in reserve to back the insurance policy contract that you pay to be protected under. Some of the larger insurance providers you may have heard of include Berkshire Hathaway, Allianz, and MetLife.

Home insurance is usually an offering by a property and casualty insurer, otherwise known as P&C. In case you were wondering, ‘casualty’ is basically another name for liability.

A P&C insurance company typically offers things like home insurance, automobile insurance, theft insurance, and liability insurance. Note that P&C companies don’t offer things like health insurance or life insurance. You may also hear the term specialty insurance or specialty insurer, which refers to companies that focus on coverage for less common assets and risks.

For home insurance coverage, insurers need a systematic, objective way to evaluate asset risk and determine fees. That process is called underwriting, which is undertaken by employees called underwriters.

Underwriters use sophisticated software that combines the mathematical concepts of statistics and actuarial science together with billions of data points about past claims history and indicators that may point to potential future claims. They source data from internal company databases, third-party databases like the LexisNexis Comprehensive Loss Underwriting Exchange (CLUE) and Verisk Location, and other sources of information like demographic and weather data.

These underwriters use their big data depositories and proprietary methods of analytical data science to examine and evaluate the risk of a future event that would result in a claim payment so they can decide:

- Whether an insurance policy should be provided for a potential customer at all

- What insurance premium to charge

- What insurance coverage to provide, under which terms

However, in order to actually provide these policy decisions to actual customers, insurers and their underwriting departments need to connect with potential clients. This brings us to producers.

Insurance Producers

The next grouping to discuss within the insurance ecosystem is the insurance producers. Producers go by a variety of titles and names: insurance agent, insurance broker, insurance intermediary, etc. In short, insurance producers are the people who connect customers desiring insurance with insurance providers.

Producers also assist customers with making a claim on their policy, if later needed. And, because they have a closer relationship with the customer, they can do a preliminary screening called field underwriting before the policy makes it to the actual underwriters at the insurer.

While all insurance producers are inherently middlemen to some degree, their relationships with customers and insurance providers can differ in a few key ways. There are four standard categories that producers typically fall into:

- Insurance Brokers: Brokers help customers find the right insurance policy by comparing coverage options from multiple insurance providers. Unlike the next three options, brokers work for and are paid by you, the customers, and not the insurance companies.

- Insurance Carrier Independent Agents: Independent agents also allow customers to shop policies from a variety of insurance providers, but they are independent contractors who unlike brokers are paid by the insurers.

- Insurance Carrier Exclusive Agents: Exclusive agents, sometimes called captive agents, are also independent contractors paid by insurers, but they only work with a single insurance provider.

- Insurance Carrier Direct Writers: Direct writers are actually employees, not independent contractors, of insurance providers, and they write policies specifically for their company.

For complex, unique construction like a shipping container home, an insurance broker or independent insurance agent is usually the option. These two producers can help you compare policies from a variety of insurers and know which insurers typically are accommodating of non-standard construction and circumstances.

Direct writers and exclusive agents can typically only offer insurance policies from a single insurer. And with the comparatively fewer policies of a single insurer, it is typically more difficult to find a policy that meets the needs of unique homes.

Regardless of the type of producers and providers you deal with, they all fall into a tightly regulated industry. Below, we discuss some of the government agencies and non-governmental organizations that help control the professional insurance industry.

Insurance Regulatory Agencies and Industry Organizations

Lastly, we have the various organizations and regulatory entities that govern the insurance industry. In the United States, these groups help form the foundation of the trust we have that insurers will remain solvent, provide the coverage they promise, and pay out fair claims when needed. A few different entities worth knowing:

- State Insurance Boards: Each US state has an insurance board, which establishes training and licensing standards for producers, determines requirements for insurers to offer policies in that state, and more. Collectively, state insurance commissioners from each state are supported and regulated by the National Association of Insurance Commissioners (NAIC). The NAIC also provides the Consumer Insurance Search tool that allows individuals to look up information on insurers like complaints and financial metrics.

- Financial Rating Companies: A handful of companies provide financial strength ratings for insurance providers, helping consumers determine if the company has the financial strength to actually pay out damages when needed without becoming insolvent. The US Securities and Exchange Commission registers these rating companies as Nationally Recognized Statistical Rating Organizations (NRSROs), and those associated with insurance ratings are A.M. Best, Demotech, S&P Global, Fitch, and Moodys. Weiss Research also provides very helpful financial strength letter-grade ratings for more insurers. For individual consumers, it’s worth checking out potential insurance companies’ ratings on several of these platforms!

- Insurance Service Office (ISO): Part of insurance data services company Verisk, the ISO’s most public activity is creating form templates that most insurers copy or at least use as inspiration for their own insurance forms. The ISO forms serve as a foundation of understanding and common language across insurers and customers. Thanks to years of precedent in case law determined by courts, using ISO forms means insurers have a better understanding of gray areas that have lawsuit potential.

- American Association of Insurance Services (AAIS): Somewhat similar to the ISO, the AAIS provides forms to the insurance industry. However, it differs in that it is a not-for-profit advisory organization.

Home Insurance Protection Overview

Insurance is a business fixated on details. If you and your producers don’t understand and communicate the details of your policy, it’s easy for something to be missed. And one of the worst situations to be in is thinking you have insurance protection when an unfortunate situation occurs, then sadly realizing you were mistaken about your protection. What are these ‘unfortunate situations’? The insurance industry calls them perils.

Simply put, perils are the actions and events you’re insuring against. What you hope will never happen, but want to be ready for if they do occur. But it’s not enough to simply be exposed to a peril. In order to ‘use’ your insurance (in other words, to file a claim), you have to have suffered a loss.

Perils and losses are directly coupled in insurance: a loss must be caused by a peril covered under your policy. With that understanding in place, we now need to dig a little deeper into the specific perils and associated protections your insurance policy offers. A typical homeowner’s policy bundles both protection for your property and coverage for liability you may incur.

Property Protection

It’s human nature to think of insurance in terms of property. Whether you’re talking about real property (ex: land and buildings) or personal property (ex: furniture and clothing), property insurance and the perils it protects against are easy to understand because they are tangible. Property coverage is called first-party coverage because it is your property that is insured. For instance, if your roof is damaged, the insurance company would pay you to fix or replace it.

Many property perils are associated with natural disasters, like lightning or freezing. Other peril examples are related to human behavior, like vandalism or theft. There are normally two ways that insurance policies approach property perils:

Property: Open Perils

These policies are also known as all-risk policies. These policies are the ‘better’ of the two options, which is typically why lenders often require them if you have home insurance required by your mortgage. While an open peril policy does provide the most coverage, it doesn’t cover every possible peril and some things you might think would be covered are left out. However, in general, we think of open peril policies as including all perils except those specifically excluded in the policy.

A few examples of potentially excluded perils in an open peril policy include:

- Ordinance or law changes

- Earth movements due to floods, mudslides, and sinkholes

- Backup of sewer or drain

- Power failure

- Neglect

- War

- Nuclear hazard

- Intentional loss

- Government action

- Theft at a dwelling under construction

- Vandalism of a long-term vacant property

- Mold, fungus, or rot

- Wear and tear

- Mechanical breakdown

- Smog, rust, or corrosion

- Smoke from industrial or agricultural operations

- Discharge, dispersal, or seepage of pollutants

- Settling, shrinking, bulging, or expanding of structure such as foundation

- Birds, vermin, rodents, insects

- Animals you own

However, there can be wide disparities in excluded perils between policies, so check the specific language in your policy documents! Remember all perils coverage is ‘EVERYTHING EXCEPT FOR what is listed’.

Property: Named Perils

You may also hear these referred to as closed peril policies, specified-peril policies, or named-risk policies. A named-peril policy is exactly what it sounds it sounds like: only the perils specifically listed in the policy are covered and everything else is not.

Most states have standardized to include either the first 10 or all 16 of the following named perils, listed in the ‘Perils Insured Against’ section of your policy:

- Fire or lightning

- Windstorm or hail

- Explosion

- Riot or civil disturbance

- Damage caused by aircraft

- Damage caused by vehicles

- Smoke

- Vandalism

- Theft

- Volcanic eruption

- Falling object

- Weight of ice, snow, or sleet

- Accidental discharge/overflow of water/steam from a plumbing, HVAC, or fire sprinkler system, or from a household appliance

- Sudden and accidental tearing apart, cracking, burning, or bulging of a steam or hot water heating system, an air conditioning or automatic fire-protection system

- Freezing of a plumbing, HVAC, or automatic fire-protection sprinkler system, or of a household appliance

- Sudden and accidental damage from artificially generated electrical current

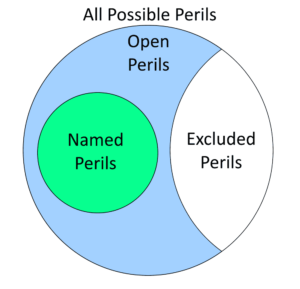

Remember named perils coverage is ‘NOTHING EXCEPT FOR what is listed’. It’s important to understand the difference between open and named peril policies. A misunderstanding of how your insurance policy addresses perils could cost you thousands of dollars if you have a claim denied that you thought would be covered. This graphic may help you process the difference visually:

Property Coverage

The perils described above obviously have the capacity to damage or destroy a variety of physical assets. So it’s important to know what types of property are actually covered by your insurance. Property coverage for home insurance is normally subdivided into the following four groups:

- Dwelling Coverage: Safeguards your home’s foundation, roof, walls, and windows. This coverage applies to anything that would not fall out of your home if it were turned upside down.

- Other Structures Coverage: Protects detached structures on your property like swimming pools, detached garages, sheds, fences, etc. In many cases, this is where an Accessory Dwelling Unit (ADU) or other types of backyard buildings would be covered in a home insurance policy. By extension, a small shipping container home behind your main home may qualify here, depending on the policy writer, size, and usage.

- Personal Property Coverage: Includes personal property that is lost, damaged, or stolen in your home. The coverage applies to furniture, clothing, appliances, and other belongings.

- Loss of Use Coverage: Helps cover living expenses, such as housing, food, and essentials, if you are forced to temporarily live elsewhere due to an event impacting your property caused by a covered peril. Sometimes this coverage is called Additional Living Expenses (ALE) insurance.

Liability Protection

Liability coverage protects you if you’re determined to be legally responsible for someone else’s losses. Liability coverage is called third-party coverage because it is someone else, a third party, who is covered on your behalf. In other words, if your actions (including the ‘act’ of negligence) create a negative impact on someone else, liability insurance is intended to protect you.

Liability Perils

When it comes to liability perils, we’re typically talking about events that could cause you to owe someone else money. Examples of liability perils include your dog biting someone, a friend slipping on your floor, etc. Unlike with property coverage, liability insurance is almost always open peril with named exemptions and exclusions, rather than named peril.

Liability Coverage

While the number of possible liability perils is almost infinite, the coverage for liabilities is not. Below are the two ways most home insurance policies cover liability:

- Personal Liability Coverage: Protects you if someone sues you due to you causing property damage or bodily injury to them. It covers your court expenses up to certain limits and provides coverage if you are found legally responsible for someone else’s loss.

- Medical Payments Coverage: Provides payment for a visitor’s medical expenses if they are injured in your home, and can also cover injuries to others that occur outside of your home in some circumstances.

Quantifying your Insurance Protection

Your insurance policy makes specific promises not only about what is covered but about how much the company will pay in the event of a claim (and how much you’ll be expected to help share the cost). This is all over and above the normal insurance premiums you pay regularly, regardless of your claim status.

Details about your policy are most commonly found on the first page of your policy documents, known as the declarations page. There you’ll find specifics about your coverage, deductibles, dollar limits, etc.

Insurance Deductibles

A deductible is the amount of money you must pay to make a claim. You can think of it as a form of cost-sharing with the insurance provider.

If you have a $2,000 claim and a $500 deductible, the insurance company will pay you $1500 and you will pay $500. Note that you might have different deductibles for different types of coverage within the same policy.

Insurance Policy Limits

All insurance policies have dollar limits which represent the maximum amount the provider will pay on a claim. These limits are often specific to each type of coverage.

The point here is that you must ensure you have enough coverage to replace your property in case of total loss. If your coverage is insufficient, you will have to pay the difference between the total cost and the dollar limit.

Insurance Coverage Loss Settlement Methods

Assuming you do make a successful claim on your insurance policy, there are a few different ways the insurance company may pay you for your losses. Understanding these distinctions is critical to being reimbursed the amount you expect! We cover the most common options below, listed in increasing order of protection.

- Actual Cash Value Coverage: Covers repair and replacement costs minus a deduction for depreciation. Depreciation is a decrease in value due to wear and age over time. For example, a 10-year-old roof might have an actual cash value of $7,000 even though its replacement cost might be $10,000. With this coverage and assuming you have a $1,000 deductible, your company would pay $6,000 towards the cost of a new roof. You would have to pay the $1,000 deductible PLUS the $3,000 difference between the actual and replacement values.

- Replacement Cost Coverage: Provides funds for repairs or replacements at current prices. For example, if you need a new roof and it costs $10,000, the policy will pay you $9,000, assuming you have a $1,000 deductible.

- Guaranteed Replacement Cost Coverage: Pays to rebuild the home as it was before the disaster, even if it exceeds the policy limit. This is helpful when there are sudden increases in construction costs, such as if your whole neighborhood is hit by a natural disaster, or there is a regional shortage of building materials. So if a new roof would have been $10,000 a month ago but now due to external factors is $15,000 (even if $15,000 exceeds your normal policy limit), the company will pay $14,000 and you’ll pay your $1,000 deductible.

Container Homes Insurance Policy Types

Given the variety of perils and coverage options we’ve presented thus far, it probably comes as no surprise that there are numerous types of container home insurance policies. Different insurance policy types combine the various elements of coverage into one policy document or form. The right insurance policy for your situation depends on your budget, house details, risk exposure, and other variables.

Even within the narrow field of shipping container home insurance, there are a variety of specific types of insurance policies that are available. Some of these categories are more well-defined than others which tend to be a bit ambiguous and overlapping.

Remember, at the very end of this article, we’ll discuss how to select the right container home insurance policy for you. Therefore in this section, focus on developing your familiarity with the various types of insurance policies that are potentially available for container homes.

Standard Home Insurance

A standard homeowners insurance policy combines property and casualty (liability) coverages into the same policy. It covers a broad assortment of perils associated with owning or renting a home, plus protection against accident liability.

There are currently eight ISO forms used for homeowner’s insurance, designated HO-1 through HO-8. However, only four of the forms will be covered in this first section on standard home insurance.

Any of these four standard insurance types would be appropriate for a container home that fits into one of the following two categories:

- A container home that is less than 1000SF, next to a traditionally constructed home (for example, an ADU, granny flat, she shed, etc. made from a shipping container), and otherwise eligible for ‘Other Structures’ coverage

- A container home that is over 1000SF, sits on owned property, was built to IRC codes, and is considered the owner’s primary residence

HO-1 Policy: Basic Form

An HO-1 insurance policy is considered the simplest standard homeowner’s insurance with the least protection. Typically, it only covers the first 10 of the 16 named perils. HO-1 policies also typically only offer actual cash value coverage, and only cover real property, not personal property or liability. This policy type is not widely available due to its lower coverage standard.

HO-2 Policy: Broad Form

When you step up to an HO-2 insurance policy, you’re buying coverage for all the normal 16 named perils, not just the first 10 as with an HO-1. Furthermore, an HO-2 form may include coverage for personal property and personal liability in some cases. You’re also typically getting replacement value coverage in most cases.

HO-3: Special Form

An HO-3 insurance policy is the most common type of homeowners insurance in the United States. The big difference here from HO-2 is that you move into open peril coverage for your real property, although your personal property may keep named peril coverage. And while personal property and personal liability coverage are only sometimes included in HO-2, they are almost always included in HO-3.

HO-5: Comprehensive Form

The coverage normally considered ‘best’ for a standard home is an HO-5 insurance policy. It offers open peril coverage for real and personal property, plus liability coverage. It also generally has larger coverage limits than an HO-3.

Dwelling Fire Insurance

Though it has the word ‘fire’ right in the name, dwelling fire insurance is a bit of a misnomer. In fact, dwelling fire coverage protects against much more than just fire damage.

The fire part of the name is just for historical reasons. And although dwelling fire insurance is sometimes informally called ‘landlord insurance’, it can be used for owner-occupied homes as well, especially those that are difficult to insure with standard homeowner’s policies. This makes it a good fit for larger container homes, especially those used as weekend cabins, rental homes, etc.

Dwelling fire coverage differs from standard home insurance in that it typically doesn’t provide personal property or liability coverage. Below we’ll discuss the three main dwelling fire forms and how they parallel the coverage of the HO forms with equivalent numbers:

DP-1 Policy (DF-1): Basic Dwelling Form

A Dwelling Fire Basic Form is similar to an HO-1 form. It only covers named perils and is normally an actual cash-value policy.

DP-2 Policy (DF-2): Broad Dwelling Form

A Dwelling Fire Broad Form policy adds a few additional named perils to a DP-1 policy, similar to how an HO-2 adds extra named perils to an HO-1 policy. A DP-2 also steps up to replacement cost reimbursement instead of actual cash value.

DP-3: Policy (DF-3): Special Dwelling Form

When you choose a Dwelling Fire Special Form policy, you’re getting the benefit of open peril coverage similar to an HO-3 form. You also keep the replacement cost reimbursement of the DP-2 form.

Manufactured Home Insurance

Manufactured Home Insurance is more of an umbrella term for a few different types of insurance. Within this section, we’re including quite a few different asset types, and the lines between each can be blurry. Examples include:

- Mobile Home Insurance

- Single-wide Home Insurance and Double-wide Home Insurance

- Sectional Home Insurance

- Modular Home Insurance

- Tiny Home Insurance

- Travel Trailer Insurance

- Recreational Vehicle (RV) Insurance

- Park Model Home Insurance

- Container Home Insurance

The unifying idea here is that all these various homes are not site-built. Instead, they are built, at least in part, in a factory, then transported to the place where they will be used (either in whole or in pieces).

Getting manufactured home insurance is also a bit tricky as well because different insurance providers treat it differently. Generally, manufactured home insurance is provided in one of five ways, depending on the specifics of your property:

- HO-7: Mobile Home Form

- MH-1: Mobile Home Form

- Mobile Home Endorsement added to an HO-2, HO-3, etc. form

- Dwelling Fire Form

- Custom Insurance Provider Form not associated with ISO or AAIS

The difference comes from how insurance and non-insurance entities work with these homes. For instance, government mortgage enterprise Fannie Mae specifies that a ‘manufactured home’ is greater than 400SF and built to the HUD code, not the IRC code. However, insurance companies don’t necessarily use those same criteria to define what will qualify for manufactured home insurance.

Some insurance companies will look for tiny homes to be certified by NOAH or RVIA depending on their mobility, while others are less strict. And some providers will accept self-built tiny home projects, while others will only work with professional builds. Note that within this discussion, we’re specifically not including insurance for RVs that have a motor, such as Class A, B, and C motorhomes. These RVs are self-powered vehicles and have insurance that is more similar to an auto policy than a home policy.

Given the flexibility of container construction with regard to size and portability, trying to use the various types of manufactured home insurance for container homes is diving head-first into a gray area. You need to be extremely specific with your insurance provider about the size of your container home, how it was built, and whether or not it has wheels.

And with so much variability in the documentation of insurance for manufacturing homes, it’s no wonder there is also variability in the coverage. Generally speaking though, a few things are usually true about insurance coverage for this type of semi-portable or modular housing:

- It typically provides coverage for named perils

- It typically only covers the home while it is stationary, and not during transit

A few examples of companies offering manufactured or mobile home insurance are Progressive, Geico, and State Farm. But there are also some more specialty providers that target the tiny home insurance market like One80 Intermediaries and Foremost.

Some type of manufactured home insurance is likely appropriate if you have a:

- Tiny home on wheels built from a shipping container

- Container home that’s less than 1000SF and exists independent of and far away from other structures on the same property

Inland Marine Insurance

Inland Marine insurance is arguably even more confusing than Dwelling Fire Insurance; the name is not very descriptive of the type of coverage you receive. And again, the reasons for the name are historical, but in the present-day, inland marine insurance is used as a bit of a cure-all for providing insurance when other more defined forms of coverage aren’t satisfactory. Inland Marine can be used to fit a large variety of situations and has a correspondingly large list of potential forms that may be applicable.

Many of these forms are non-filed, meaning they aren’t overseen by the state insurance departments due to their international usage and lack of state regulation. But most inland marine coverage will, at minimum, include these two filed forms:

- CM 00 01: Commercial Inland Marine Conditions

- IL 00 17: Common Policy Conditions

A fairly straightforward application of inland marine insurance would be for shipping containers used for storage, but we’ve heard of occupied shipping container homes using this type of insurance as well. With the right producer as your advocate, inland marine insurance for your container home might be a possible option.

Inland marine insurance is common, with no shortage of providers offering it. A few well-known examples are DSV, Travelers, and The Hartford.

Other Insurance Coverage Less Relevant for Container Homes

In the previous sections, we covered the most common types of home insurance that had a strong possibility of being applicable to many container homeowners. In this section, we’ll briefly touch on some of the other common types of home insurance that typically do not apply to container home ownership.

HO-4: Contents Broad Form

This type of insurance is intended specifically for people who rent rather than own a home. With the growing number of container apartments and other multifamily container developments, there is a small but increasing number of container home rentals available.

With HO-4 insurance, you’re protected with named perils coverage for your personal belongings, and often for liability as well. Contents broad form insurance exists because most landlord insurance only protects the structure, and not the tenant’s belongings.

HO-6: Unit-owners Form

Consider the difference between a condominium and an apartment: while both often have shared walls and a similar appearance, the apartment is owned by a company while a condo unit is owned by an individual. However, the shared spaces of a condo are ‘owned’ by a Homeowner’s Association (HOA).

The HO-6 insurance policy is for people that own condo units. While the HOA will have its own insurance policy for the overall building structure and common areas shared by unit owners, an HO-6 policy will provide named peril coverage for essentially everything from the walls inward of your condo unit. This normally includes coverage for your personal property and liability as well. In short, it’s fairly similar to an HO-3 policy but geared toward a condominium or cooperative housing building.

There are essentially no shipping container condominiums available for purchase, so this type of insurance is unlikely to apply to most container homeowners.

HO-8: Modified Coverage Form

As we move to even more obscure insurance forms, we find HO-8 insurance. This modified coverage form insurance is nominally intended for homes that don’t meet normal standards of coverage required by other homeowner’s insurance types. In practice, the HO-8 form is used primarily for older homes and offers named peril coverage.

Older, historic homes are often built with specific craftsmanship and materials that are not easily or cheaply repaired or replaced in the case of a loss. An insurer can quickly get into a situation where the replacement cost of part of the home is much higher than the current cash value.

A container home doesn’t really match up with the intent here. While a container’s construction is less common than traditional construction, it’s not typically more expensive and doesn’t utilize expensive, hard-to-source materials. For this reason, it’s unlikely that an insurance provider would use an HO-8 form for a container home.

Supplemental Coverage Options

Finally, the last type of coverage we want to discuss is not actually standalone coverage at all. Rather, it’s a type of coverage that can be added to one of the previously shared insurance options.

In the insurance world, you may hear this go buy a few different names like supplemental coverage, insurance endorsement, or policy rider. Regardless of the name, the purpose is to extend the normal coverage of a standard form into new areas. It’s essentially a way that an insurance producer can customize a policy to your exact needs.

What are some examples of the additional coverage you might add to your container home policy?

- Add on for traditional renters or short-term rental usage

- Add on for coverage from perils like high winds, hail, flooding, and earthquakes

- Add on to increase the limits of your coverage, like adding a higher personal injury protection limit

- Add on to include coverage for normally excluded conditions like non-standard construction materials

- Etc.

There’s no way to give an exhaustive list of potential endorsements here. Instead, work with your insurance provider to see if they can tailor a standard policy to fit your unique situation through the use of supplemental coverage. This may be a way to get coverage for your container home.

Container Home Insurance Bet Practices

We’ve just discussed several of the options in the world of home insurance and how each applies to the various types of shipping container homes you may have or be considering. Below we give some helpful information about actually selecting the right policy type and insurance partners.

Communicating your Situation

Just as we recommend when dealing with building code officials, it’s also important to choose your words carefully as you discuss container house insurance policies. Some people have preconceived notions of what you mean when you say ‘container home’ that may not match up with what you’re actually building.

Instead, focus on using terms that are accurate and specific. Words like ‘steel construction’, ‘code-compliant’, etc. may help better get the point across without confusing the listener. Also, be sure to have plenty of backup information on hand including photographs (finished and under construction) and other documentation.

Evaluating Insurance Providers and Producers

It’s important that the team of producers and providers you work with are financially healthy and have a good track record of customer service. Check the providers against the previously shared scoring systems like credit ratings to insure the company is well-equipped to endure for decades.

Check the producers on consumer rating sites like Google Maps, Yelp, etc. to see how other customers feel about their service. Ask the producers themselves for references/testimonials when possible, what their retention rate for customers is, and also get clarity on how your claims will be handled.

Understanding Home Insurance Cost Factors

Your insurance premium is developed by a complex algorithm that takes into account a variety of factors. The fact that your home is built with shipping containers is only one of those factors, and although it’s an important one, it’s also important to understand the other factors as well.

Below are a few of the main cost factors, many of which you have control over during the design/planning stage of your container home project:

- Age, condition, and size of your home

- Your planned usage

- Location of your home with regards to perils (both natural and man-made like criminal activity)

- Location of your home with regards to local fire and police protection, local contractors, available building materials, etc.

- Other ancillary factors like having a trampoline/swimming pool, pets, a security system, etc.

- Your claims history

- Your financial health (primarily credit score)

- Your desired coverage limits and deductibles

Simply put, anything that your insurance provider thinks increases your risk of filing a claim (or increases the amount of a claim) will increase your insurance premium.

Summary

If you made it all the way through, congratulations. This article, while long, thoroughly informed you about not only why you might need container home insurance, but how to find it. Container homes are new and different, part of what makes them exciting. But that also makes finding the right home insurance policy challenging.

But with the right resources, challenges can be overcome. And our hope is that after reading the article, you’ll have the confidence and know-how to find the right insurance team and policy to help protect your most valuable asset, your home.

If you have had an experience, good or bad, with locating and purchasing container home insurance, we’d love to hear about it. Leave a comment below to continue helping out the container home community!